Search This Supplers Products:Medical dressing and plastermedical elastic bandagesurgical tapesports tapemedical plastersports supports products

Monitoring of cotton yarn for medical gauze market from July 20th to July 27th, 2021

time2021/07/28

- Monitoring of cotton yarn for medical gauze market from July 20th to July 27th, 2021,the cotton wool futures market soars, prices are rising steadily

On July 27, the opening price of the main cotton yarn for medical gauze 2109 contract was 25810 yuan/ton, and the settlement price was 26950 yuan/ton. The highest reported 27,330 yuan/ton, the lowest reported 25,705 yuan/ton, and the closing price was 27,185 yuan/ton, up 5.45% from the previous trading day. The trading volume was 43306 hands and the open interest was 13,101 hands.

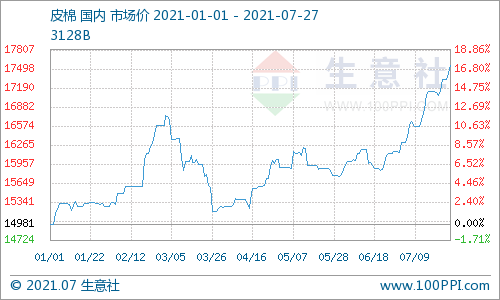

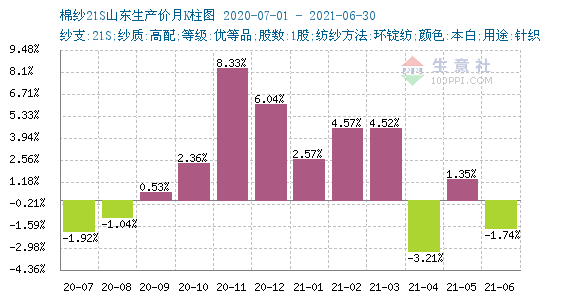

Market analysis: The domestic cotton wool market rose steadily. On July 27, the average price of China's cotton wool index 3128B was 17,503 yuan/ton, an increase of 115 yuan/ton from the previous day. The transaction of reserve cotton is hot, and the average transaction price is higher than the spot price, which provides price support for the cotton spot. At the end of June, the country’s total cotton commercial inventory was about 3.017 million tons, a decrease of 15.67% from the previous month and a year-on-year decrease of 6.84%. USDA's July report slightly lowered global inventories; domestic new cotton planting area declined. The survey results showed that the national cotton planting area in 2021 was 43,455,900 mu, a year-on-year decrease of 5.47%. Although the downstream textile industry is in the traditional off-season, the off-season is not short, the inventory of cotton yarn enterprises is low, and the operating rate is relatively stable.

Outlook forecast: The downstream textile market demand is good, the operating rate of enterprises remains high, and the domestic cotton wool commercial inventory continues to decline. The current cotton wool and medical gauze futures market has reached the highest price in recent years, and the market outlook for cotton can be expected. Taking into account that the current market has pulled up more than expected, be wary of corrections.